The comfort of financial planning

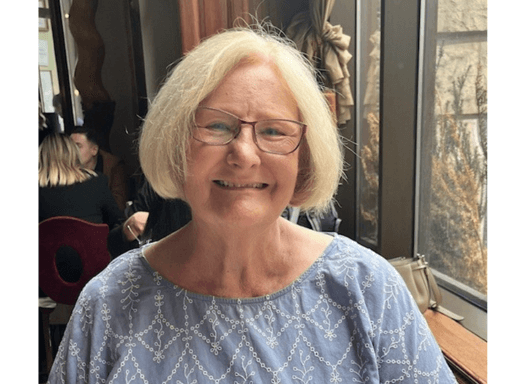

04 Dec 2025 2 min read After a fulfilling career teaching secondary mathematics, Tricia is now enjoying a well-earned retirement, and she credits careful planning and the support of NGS Super for helping make it possible.

After a fulfilling career teaching secondary mathematics, Tricia is now enjoying a well-earned retirement, and she credits careful planning and the support of NGS Super for helping make it possible.

Tricia began her teaching career in the early 1980s, making voluntary super contributions to her super savings from the start. She retired at the end of 2020 after three terms of long service leave, but her love of education didn’t stop there. Tricia continued contributing to young minds through one-on-one tutoring for several years, working from her local library.

Tricia thought ahead and, as a result, designed retirement to suit her needs. “I have always salary sacrificed, and I’m pleased I did that. But I also engaged an NGS Financial Planner to help prepare and plan for retirement. It provided the comfort and support I needed to make the best decisions for me,’ says Tricia.

Support from an expert

When it came time to think seriously about retirement, Tricia knew she wanted expert support.

“Super is complicated. I wanted someone qualified who could help me understand it properly,” she explains. Her adviser, Darryn, worked with her from the late 1990s. “He explained where our money was invested, reviewed our risk profile, and provided clear information. It made us think more deeply about our decisions.”

Tricia appreciated that NGS planners are employed by the fund, not paid on commission. “That mattered,” said Tricia. “It meant the advice was for our benefit, not theirs.” Fees and performance also stood out: “The admin and meeting fees were lower than other places, and the returns impressed us so much my husband switched from a retail fund.”

When it comes to super, legislative changes, transition rules, and investment options can feel overwhelming. “The rules keep changing. Having someone to guide us made a big difference.” Also, despite market ups and downs over the years, her experience has been consistently positive. “The returns have been strong over time, even with volatility.”

Transitioning to retirement with confidence

Tricia believes one-on-one advice is key. “It’s really important to have someone who knows what they’re doing and can answer your questions, even the ‘silly’ ones.”

She says working with her planner helped her understand her budget, plan for travel, and feel secure in her choices. “NGS kept us informed, but having Darryn there to explain the details helped us make sensible decisions.”

A life well planned

Today, Tricia enjoys spending time with family, her children now living in Sydney and on the North Coast and exploring the world with her husband. European adventures are a favourite, often travelling for six to ten weeks at a time. Tulip season in Amsterdam, the charm of Austria and Germany, and time in Budapest and Copenhagen have been highlights. “We used to travel when we could, but now we can really enjoy it without time restrictions.”

Advice your way

If you’re looking for help to meet your financial goals, we’re here to help. Whether you’re after simple advice over the phone or fully tailored financial planning, the choice is yours. NGS Super offers a range of advice, no matter where you are on your journey.

Helpline

Sometimes a quick phone call is all you need. To speak to someone from our Financial Advice Helpline, contact us and we’ll set up a time for you.

Phone us on the financial advice helpline.Super Specialist

Chatting with a Super Specialist could be the right option if you're looking to delve a little deeper, but don't need an entire financial plan.

Chat with a Super Specialist.Financial planner

NGS Financial Planners can give you expert strategies tailored to your circumstances, to help you achieve your financial goals.

Meet with a financial planner.The views expressed in this testimonial are the personal experiences of one member and may not be typical. This testimonial was provided for general information only and does not take into account your objectives, financial situation or needs. Before acting on this information, or making an investment decision, consider whether it is appropriate to you and read our Financial Services Guide, Product Disclosure Statements and Target Market Determinations available at ngssuper.com.au. You should also consider obtaining financial, taxation and/or legal advice tailored to your personal circumstances before making a decision. This information has been issued by NGS Super Pty Ltd ABN 46 003 491 487 and AFSL 233 154, as trustee of NGS Super ABN 73 549 180 515.

Call us on 1300 133 177 if you would like to speak with us further, or you can discuss matters with one of our NGS Super Specialists or an NGS Financial Planner.

.png)