NGS Super statement on responsible investment

14 Dec 2023 2 min readThe ABC has made a number of misleading comparisons and inaccurate claims in an article, ‘Selling the Green Dream’, published on Thursday December 14, 2023 — and NGS Super has requested a correction be published.

The ABC’s comparison of NGS Super as an aggregate fund with much smaller investment options dedicated to sustainable or ethical investing within funds, is misleading and inaccurate. Ensuring Australians are accurately informed about how their retirement savings are invested and how responsible investing principles are applied to their investments is critical and at the essence of avoiding greenwashing. The ABC has a responsibility to correct the record to prevent misleading all Australians with super savings.

NGS Super does not have sustainable or ethical investment options. Responsible investment is ingrained in everything we do. However, the ABC has compared ‘apples with oranges’ by taking the full value of assets held across the NGS Super fund and listing this alongside specific assets held within individual investment options at other funds, dramatically skewing the figures.

The article also includes sweeping statements that strongly imply disconnect between policy and investments, such as “In many cases, they do not completely prohibit investment in fossil fuels.” NGS does not state that we prohibit investment in fossil fuels completely — in fact, the definition of what we exclude is printed directly next to the point in our Responsible Investment Policy, which is publicly available on our website. This reporting is deliberately misleading.

NGS Super has a clear, and what has proven to be an effective plan to be carbon neutral by 2030. Part of this plan is to continue to divest in fossil fuels in a sustainable way that considers both investment risk and returns and climate risk.

NGS Super invests by balancing the need to manage investment risk and climate risk, while maximising returns for our members. We were the first super fund to set a target of 2030 for a carbon neutral investment portfolio and we’re making faster-than- expected progress towards this ambitious goal. We’re doing this transparently and whilst protecting our members’ investment returns.

Our investment decisions are always aligned with our responsible investment policy. Our policy clearly states that the fund excludes companies in the oil and gas production and exploration sector, as defined by the GICS sub-industry. We stand by the fact that all our current investments are consistent with this position.

We’re not an ethically based or accredited as a sustainable investor which means we don’t apply negative or positive screens based on ideology. Rather, responsible investment is engrained in everything we do.

We transparently provide our members with information about why and how we invest and protect their retirement savings. We also encourage all super fund members to contact their fund directly if they have questions about where their money is invested and why.

The independent body, Market Forces, recently ranked NGS Super’s default investment option as the number one fund least exposed to their index of companies labelled as ‘Climate Wreckers’. Our carbon intensity fell by nearly 20% between 30 June 2021 and 30 June 2022 in the NGS Diversified MySuper portfolio and we’ve divested $191 million AUD from carbon-intensive companies/industries since the start of our decarbonisation process, including our 2022 divestment from undiversified oil and gas producers including Santos and Woodside.

To achieve a carbon neutral portfolio, we’re focused on carbon reduction and investing in carbon positive assets or companies. We’re invested in areas such as clean energy infrastructure (wind and solar projects), storage infrastructure and grid technology.

We assess individual companies on a case-by-case basis to identify structural winners that are transitioning their business models and those that continue to produce fossil fuels and pose significant stranded asset risk. Stranded asset risk involves assets which are unable to meet their original economic return. This includes the offshore oil majors such as Exxon and Chevron, which we’re currently evaluating.

We recognise that the world still has a need for oil and gas, but we also recognise that companies operating in this space must have a plan to transition into renewables to be considered a responsible investment. BP and Shell and Total Energies are investing in renewable energy projects such as wind and solar.

We make decisions to divest in a company or industry such as tobacco, based on whether we believe their future revenue will be impaired, that is whether they are likely to become a stranded asset, in investment terms, impairment means a permanent reduction in the value of a company asset. Our consideration of the gambling sector follows the same logic.

Our members’ financial interests will always be the first consideration throughout our decarbonisation journey. NGS takes a continuous improvement approach in responsible investment. That's why our Investments team works hard to create a robust portfolio that integrates responsible investments and achieves strong returns over the long term.

Below is an overview of the inaccurate and misleading statements which appeared in the ABC's story.

Correction statements

Article statement: Almost all of Australia’s big super funds offer their members an investment option that avoids environmentally unsustainable industries like coal, oil and gas.

Factually incorrect: NGS Super does not offer an investment option that explicitly avoids environmentally unsuitable industries like coal, oil and gas.

Article statement: Most of them also promise to exclude investment in industries like tobacco, gambling, uranium, alcohol and weapons.

Factually incorrect: NGS Super does not make this promise to exclude gambling, uranium or alcohol. We exclude tobacco and have threshold levels around weapons.

Article statement: But an ABC analysis of financial disclosures of the sustainable or ethical-labelled super options has revealed 12 of them collectively hold almost $1.2 billion worth of fossil fuel industry shares.

Factually incorrect: NGS Super does not offer a sustainable or ethical labelled super option.

Article statement: We’re aiming to achieve a carbon-neutral investment portfolio by 2030, and investing responsibly and sustainably will help us get there,” it says on its website.

Misleading: This statement is backed by a transition plan and key targets. The linkage between our carbon neutral target and holding fossil fuel companies misrepresents what we say we do.

This was outlined when we first announced our carbon neutral strategy in 2021.

Article statement: It is not the only green-labelled fund with substantial investments in fossil fuels.

Our investigation analysed the shareholdings of all “sustainable” or “ethical” options offered by Australian super funds — as well as funds that apply sustainable or ethical principles across all their investment options.

Misleading: There is no definition of a green labelled fund in the article however the article compares sustainable/ethical options against NGS targets of reaching carbon neutral by 2030.

These two things are mutually exclusive, and the nexus drawn between the two is misleading.

The article refers to “funds” and then “options”. However, the supporting analysis compares Sustainable or Ethical options against NGS Diversified Mysuper option which is not branded this way. The distinction is important because comparing a whole fund to an investment option of a fund does not compare apples with apples and will mislead and confuse members of the public.

Article statement: NGS has a responsible investment policy that applies to all, except one, of its investment options, and promises to limit holdings in fossil fuel companies.

Yet NGS’s most recent financial disclosures reveal millions of dollars invested in the world’s biggest oil and gas producers, including ExxonMobil.

Factually incorrect: NGS’ Responsible Investment Policy does not promise to limit holdings in fossil fuel companies. We explicitly exclude companies that are classified, by MSCI, as oil and gas production and exploration and have revenues above 30% which come from thermal coal. Our holdings reflect this policy.

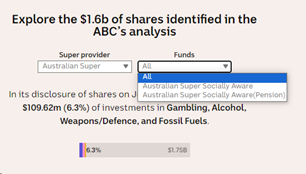

Article statement:

Misleading: In this interactive tool, a reader can choose all investment options when NGS Super is selected. However misleadingly, you can choose only socially/responsible options for the others (except Australian Ethical). NGS does not have a socially/responsible option. The tool does not provide an appropriate basis of comparison. It does not allow the reader to compare apples with apples and unfairly prejudices NGS Super.

Article statement: So why are super fund options labelled “sustainable” or “ethical” investing in these industries?

... For example, NGS Super’s policy excludes investment in companies that make more than 30 per cent of their revenue from thermal coal mining. As a result, BHP is not excluded because the $US3.5 billion it earned mining thermal coal last financial year only accounted for 6.6 per cent of its total revenue.

Factually incorrect: NGS Super does not have sustainable or ethical investment options. Responsible investment is ingrained in everything we do. The article compares ‘apples with oranges’ by listing the value of assets held across the fund with assets held within individual investment options, erroneously skewing the figures.

Article statement: These funds hold more than $60 billion worth of members’ retirement savings.

Misleading: This is cherry picking. The Australian superannuation industry is a 3.5 trillion dollar market, this article only focuses on 60 billion of it. NGS makes up approximately 25% of the ABC comparison set, but 0.4% of the overall superannuation industry. NGS Super does not have sustainable or ethical investment options.

The article compares small “sustainable” or “ethical” options of larger funds, to NGS’s whole fund.

A like for like comparison at the whole fund level would show NGS as industry leading.

Article statement: In total, NGS has almost half a billion dollars invested in 26 publicly listed fossil fuel companies.

Factually incorrect: NGS’ investment in all listed energy companies (which includes anything that could reasonably be called a fossil fuel company) totals 127 million.

Article statement: At June 30, NGS held about $306 million worth of BHP shares, making it the fund’s single biggest shareholding.

Misleading: Lacking important context.

BHP is the biggest company in Australia. Most super funds will have BHP as their largest holding. Isolating NGS like this without giving any context is misleading. On 30 June 2023 BHP comprised over 10% of the ASX 300 index, this is the regulator’s benchmark which all super funds are measured against under the Government’s Your Future Your Super reforms.

Factually incorrect: BHP is not a fossil fuel company. BHP does not have a fossil fuel division as at 14/12/2023. Their operating divisions are Copper, Iron Ore, Nickel, Metallurgical Coal and Potash.

On 1/6/22, BHP divested its Oil and Gas assets to Woodside. Woodside is on the NGS restricted list.

Article statement: It pointed to a footnote to its responsible investment policy that defines oil and gas producers according to an industry classification called “the GICS sub-industry”.

Misleading: It is not that NGS’ Responsible Investment policy defines oil and gas producers using GICS sub-industry classification. The policy does not define anything, instead NGS clearly state we exclude oil and gas exploration and production. The footnote explains how we implement that in practice for the purpose of full transparency.

Article statement: The format of the disclosures is inconsistent between the super providers and can contain thousands of rows of data for each portfolio. For the average member, assessing a fund’s offering and comparing it to a competitor can be an onerous task.

Misleading: Disclosure is consistent with the requirements of the law. To assist members, NGS includes summaries of the holdings on the website. This includes holdings split by sector.

Article statement: RIO Tinto classified as a fossil fuel company.

Factually incorrect: Rio does not have a fossil fuel division. Their products are: Iron Ore, Bauxite, Alumina, Aluminium, Mined Copper, Refined Copper, Diamonds, Titanium Dioxide, Boric Oxide Equivalent.

Article statement: Worley Ltd classified as a fossil fuel company.

Misleading: Providing engineering consulting to oil/mining sector as part of their services doesn’t necessarily mean they are exposed to the stranded asset risk of oil producing companies.

Factually incorrect: Worley is a consulting and advisory services business. In 2020, Worley has set a net zero S1/S2 emissions target for 2030, which is consistent with NGS' ambitions. Worley's strategy is to derive 75% of revenue from sustainability-related work by FY26.

Article statement: Total and Equinor are listed as a fossil fuel company.

Misleading: These companies are also leading the transition, investing in renewable energy projects. They are good examples of companies that have demonstrated via announced targets, policies and investments that they are transitioning their business models to adapt to a low carbon world. By investing, NGS are supporting this transition.

Article statement: Uranium Investments

Misleading: Uranium used in nuclear power generation has no carbon emissions.

Article statement: Data is based on ABC analysis of the listed equity asset class in the product holdings disclosures. It is checked against the Bloomberg equity screens.

Misleading: NGS invests across listed assets and unlisted assets plus cash. It is misleading to only look at the listed equity asset class because this is only part of the portfolio. Most members are invested in the MySuper diversified option.

By cherry-picking only listed equities, the analysis does not reflect the true proportionality of the holdings.

Article statement: The ABC cleaned and collated this data and compared the shareholdings in these disclosures with lists published by Bloomberg of public companies globally that report revenue from fossil fuel mining and exploration, tobacco, gambling, alcohol, uranium and weapons manufacturing and military contracts.

The figures we have used represent the value of these holdings at June 30 this year.

Misleading: It is not clear what threshold if any ABC is using with respect to revenue exposure to classify a company as having exposure to these industries.

If a mining company generates 94% of its revenue from mining and 6% from fossil fuels it is misleading to classify it as an investment in fossil fuels.

Similarly if a supermarket generates 85% of its revenue from food, 10% from alcohol and 5% from tobacco it can’t be double classified as a tobacco and alcohol company. This inconsistent treatment is misleading, in that tobacco is not shown in the interactive infographic.

Factually incorrect: It is factually incorrect to say that NGS has this level of exposure.

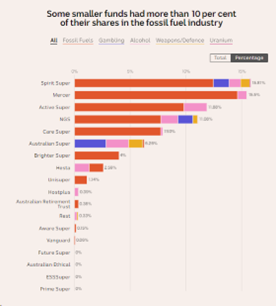

Article statement:

Misleading: This table does not distinguish that these are ethical and sustainable options of the other super funds. NGS Super does not offer a sustainable or ethical labelled super option.