Got time on your side? Why your investment option matters

16 Jul 2025 3 min readIf you’re between 18 and 35, you might not spend much time thinking about your super. You may have other priorities like paying rent, HECS, or saving for a home. Super can feel distant and abstract. But here’s something worth knowing, the choices you make with your super now could shape your future.

Future you will thank present you

The good news is, you’ve got time on your side. With 20 to 30 years of investing ahead of you, it’s the right time to think about what decisions you can make today to help grow your super.

Growth vs Defensive – what's the difference?

At NGS Super, we offer a range of investment options to suit different goals and risk appetites. But for members in the accumulation phase (that’s you if you’re in the early stages of your career), options with more growth assets – like shares and property - may make the most of your time horizon. These options have greater potential for higher long-term returns but tend to be more volatile in the short term. Compare this to defensive assets – like cash or bonds – which are generally more stable but earn lower returns over time.

As an NGS member you can make up your own mix of growth and defensive assets or you can choose from one our pre-mixed options which range from High Growth - with roughly 90% in growth assets and 10% in defensive assts. Defensive has roughly 38% in growth assets and 62% in defensive assets. If you do nothing, you’ll automatically be invested in our Diversified (MySuper) option, which has roughly 76% in growth assets.

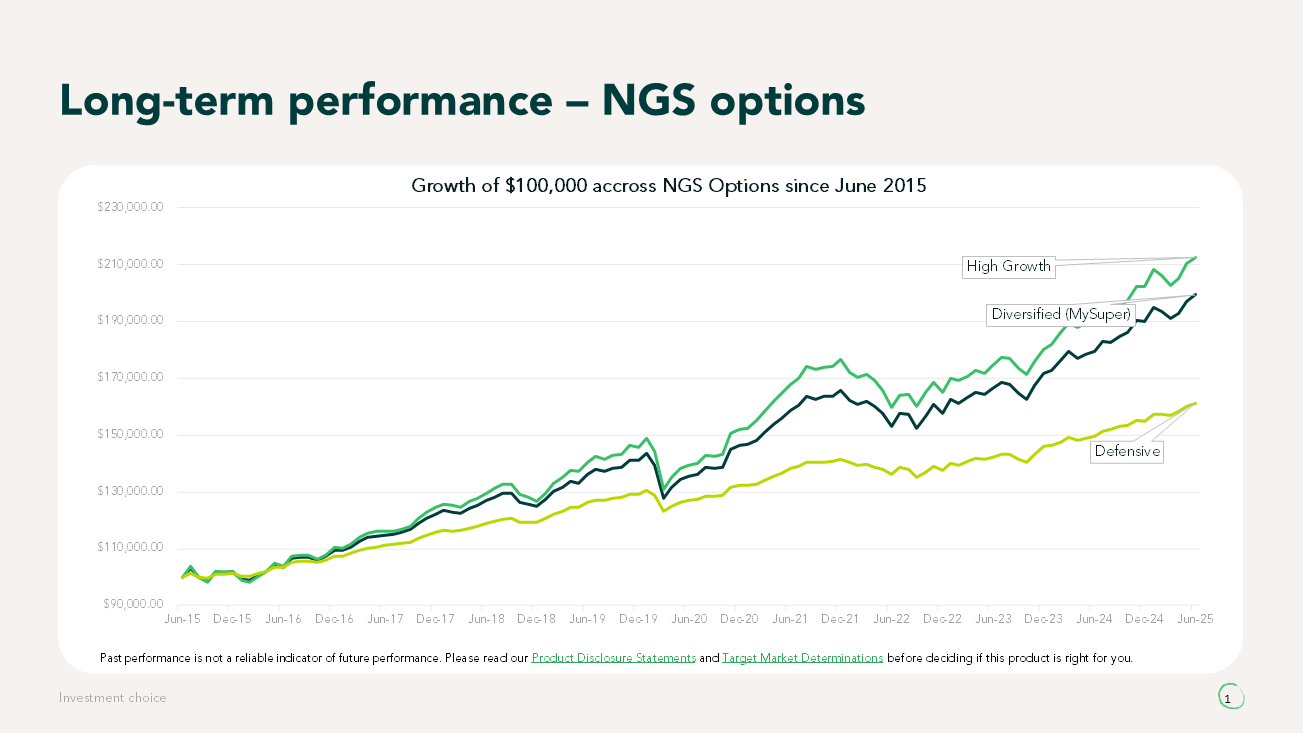

Here’s how that plays out in the real world.

Past performance isn’t a guarantee of future returns – but history shows that growth assets outperform defensive assets over the long term.

Why it matters for accumulators

With time on your side, you’re in a unique position and may want to consider taking on more investment risk now and potentially benefiting from stronger long-term returns. Over 7+ years, growth assets have generally outperformed more conservative options.

Yes, there will be ups and downs along the way (markets can be volatile) but staying the course could mean a much bigger balance down the track.

The trade-off: higher growth, higher risk

Higher returns come with higher short-term risk, that’s normal. Growth options can fluctuate more year-to-year, but over decades, they’ve tended to recover and keep climbing. If you’re not planning to access your super for another 30 years, these short-term bumps are less of a concern.

What’s important to understand is that when it comes to super, it pays to stay informed. Learn all you can to choose a strategy that suits your personal circumstances and goals.

What does this look like in real life?

Let’s say you’ve got $20,000 in super at age 30 and you earn $90,000 per annum. If your super is invested in a moderate growth option with around 70% in growth assets, it might grow to $467,000 by retirement. But in a high growth option with around 90% in growth assets, it could be worth $569,000 – that’s over $100,000 more, just from the investment choice alone.*

*Assumes continuous employment through to retirement at age 65 with employer contributions of 12% p.a., salary increases annually by 3.7% long-term average returns of 5.5% p.a. for moderate growth and 6.5% p.a. for high growth (net of investment fees and tax). Actual performance will vary. All values are in today’s dollars (allowing for inflation of 2.5% p.a. and lifestyle improvements of 1.2% p.a.). For more information on the assumptions used, go to ngssuper.com.au/super-calculator

What you can do now

You don’t have to be an investment expert. We’re here to help you make smart, informed decisions.

Here’s how to start:

- Check your current investment option – Log in to Member Online

- Consider your investment option – considering your timeframe and goals.

- Get guidance – Book a chat with an NGS Super Specialist to walk you through your investment options.

- Track your balance – It’s easier than you think to stay across your super with Member Online.

Build confidence, not just savings

By getting your investment settings right now, you’re setting your future self up for choice, freedom, and financial confidence.

This is general information only and does not take into account your objectives, financial situation or needs. Before acting on this information, or making an investment decision, consider whether it is appropriate to you and read our Product Disclosure Statements and Target Market Determinations. You should also consider obtaining financial, taxation and/or legal advice tailored to your personal circumstances before making a decision. This information has been issued by NGS Super Pty Ltd ABN 46 003 491 487 as trustee of NGS Super ABN 73 549 180 515, RSE Licence L0000567 and AFSL 233 154.

Call us on 1300 133 177 if you would like to speak with us further, or you can discuss matters with one of our NGS Super Specialists or an NGS Financial Planner.