Carbon Neutral Goal progress report as at 30 June 2024

10 Jul 2025 8 min readThis update contains statements regarding possible future events that are uncertain. As such, please ensure you read the disclosure on forward looking statements in Important Information.

Introduction

In 2021, NGS Super Pty Limited (NGS Super) as Trustee for NGS Super (the Fund) set a goal to deliver a carbon neutral1 investment portfolio for our Diversified (MySuper) investment option by 2030.2 This goal is referred to as the Fund’s Carbon Neutral Goal3 In 2022, we made the further decision to set an interim target of a 35% reduction in carbon emissions4 from our original baseline5 by 2025

We committed to updating the membership annually on:

- progress towards the targets set

- how this progress plots on the Fund’s carbon neutral glide path through to 2030 while being transparent about any adjustments which become apparent through the annual review process, and

- the results of the scenario analysis.6

30 June 2024 carbon intensity results

Carbon intensity of the Diversified (MySuper) investment option at 30 June 2024

The Fund measures the carbon intensity7 in our portfolio by measuring the number of tonnes of carbon dioxide (or its equivalent) emitted per millions of dollars (AUD) invested. Results for the financial year ending 30 June 2024, showed that the carbon intensity of the Diversified (MySuper) investment option fell to approximately 22 tonnes of carbon dioxide (or its equivalent) emitted per one million dollars (AUD) invested. This is expressed as 22 tonne of carbon dioxide equivalents per million $AUD invested (tCO2e/AUD) million invested.

Table 1 below illustrates the carbon intensity calculations of the Diversified (MySuper) investment option from 2021 – 2024. There was a slight increase in the carbon intensity of the international shares, infrastructure and private equity sectors however these were offset by the reductions that came from Australian shares, property and fixed income sectors. Most of this reduction came from the Australian shares sector.

| June 2021 (tCO2e/AUD million invested) Baseline measurement8 |

June 2022 (tCO2e/AUD million invested)8 | June 2023 (tCO2e/AUD million invested)8 | June 2024 (tCO2e/AUD million invested)8 | |

|---|---|---|---|---|

| Diversified (MySuper) scope 1 and 2 emissions | 48.0 | 38.0 | 27.4 | 22.1 |

| % change on prior year | N/A | -20.8 | -27.9 | -19.3 |

Table 1 – Carbon intensity of Diversified (MySuper) investment option and % change

Updated glide path through to 2030

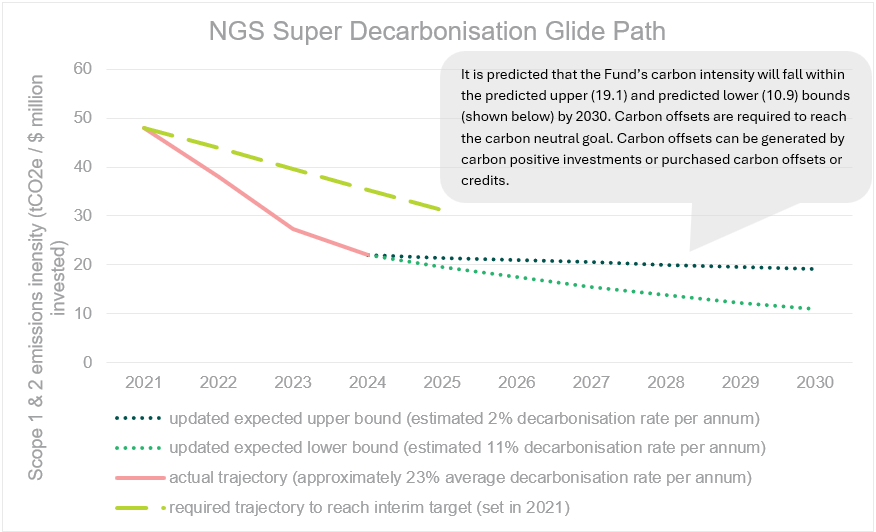

The Graph 1 below plots the 30 June 2024 carbon intensity of the Diversified (MySuper) investment option on the Fund’s glide path for both our 2025 interim target9 and our end target10 of delivering a carbon neutral Diversified (MySuper) investment option by 2030. The solid pink line illustrates the 54% reduction (approximately)11 in carbon intensity achieved since we began our measurements in 2021.

Graph 1 - The Fund’s Diversified (MySuper) option decarbonisation glide path

While the glide path has been presented as linear, the transition to the low-carbon economy, and the Fund’s pathway, is not expected to be linear. There will be ups and downs along the way, as many companies and industries may see an increase in carbon intensity as they develop more sustainable low-carbon operating models. Graph 1 has been prepared based on current information and assumes no change to external factors such as (but not limited to) geopolitical factors, changes to law and/or policies and practices of government, government and/or regulatory bodies.

Re-evaluation of scenario analysis

The Fund updated its climate scenario analysis as of 30 June 2024 which saw the completion of physical and transitional scenario analysis based on the Network for Greening the Financial System Net Zero 2050, Delayed Transition and Nationally Determined Contributions scenarios.12 This analysis covered approximately 80% of the Funds’ assets under management. A high level summary of the scenario analysis can be found in the following document: Summary of Annual Climate Scenario Analysis at 30 June 2024.

Members’ best financial interests is paramount

As we work towards our carbon neutral goal for the Diversified (MySuper) investment option, acting in the best financial interests of our members is always our first consideration. As illustrated in Graph 1, there will be residual emissions which will require offsetting to deliver on the carbon neutral goal. If we determine that meeting the carbon neutral goal cannot be achieved in members best financial interests, we will adjust our target and/or timeframes and communicate this accordingly.

Important information

This is general information only and does not take into account your objectives, financial situation or needs. Before acting on this information, or making an investment decision, consider whether it is appropriate to you and read our Product Disclosure Statements and Target Market Determinations. You should also consider obtaining financial, taxation and/or legal advice tailored to your personal circumstances before making a decision.

Information on carbon intensity is emerging and emissions information from NGS Super’s investments is not always available. As such, the NGS Super has had to rely on and use estimates in providing this information as well as materials from third party sources. NGS Super cannot guarantee that such information is accurate, complete or timely and is subject to change.

Past performance is not a reliable indicator of future performance, and any market projections and predictions are based on current assumptions and are subject to change. These are not guarantees of future results. Further, this update contains statements that are “forward-looking statements” (including, goals, glide paths or targets). These statements are based on the NGS Super’s current beliefs and involve known and unknown risks, uncertainties and other important factors that could cause actual results to be materially different from the information set out in this update. Therefore, care should be taken before relying on statements in this update.

The external links used in this update are for information purposes only. NGS Super has no direct control over the content of linked sites. Links to external websites are not an endorsement or recommendation of the material on those sites.

Responsible investment (including environmental, social and governance issues) means different things to different people. Read the Responsible Investment Policy to find out what responsible investment means to NGS Super.

The information in this report is current as in July 2025.

This information has been issued by NGS Super Pty Ltd ABN 46 003 491 487 as trustee of NGS Super ABN 73 549 180 515, RSE Licence L0000567 and AFSL 233 154.

1 Based on scope 1 and scope 2 emissions of our investments.

2 The term ‘portfolio’ throughout this article refers to the Diversified (MySuper) investment option.

3 The goal is to lower the Scope 1 and Scope 2 emissions from Diversified (MySuper) investments and, each year from 2030 onwards, to offset any remaining Scope 1 and Scope 2 emissions from Diversified (MySuper) investments where it is in the best financial interests of members in that year. For the avoidance of doubt, scope 3 emissions from the Diversified (MySuper) investments are not included in this goal.

4 Based on scope 1 and scope 2 emissions of our investments.

5 The baseline measurement was completed as at 30 June 2021.

6 The Fund completes scenario analysis at sector level. As at 30 June 2024 approximately 80% of the total Fund’s assets underwent a form of scenario analysis. The analysis completed was based on a mixture of actual asset information and or holdings and analysis of sectors using proxy data.

7 Contact us for more information on how we measure carbon intensity.

8 Contact us for more information on how we measure carbon intensity.

9 35% less emissions on the 2021 baseline level.

10 Carbon neutral Diversified (MySuper) investment option by 2030.

11 The percentage change = (22 – 48) divided by 48.

12 These are scenarios developed by the Central Banks and Supervisors Network for Greening the Financial System (NGFS). The NGFS is a group of central banks and supervisors that exchange experiences, share best practices and contribute to the development of environment and claim risk management in the financial sector and mobile mainstream finance to support the transition toward a sustainable economy.